Stop Saying 'No' to Good Borrowers

Optimize Risk and Reward with T°Score™

Find the Invisible Primes™ that traditional credit scores miss. T°Score™ is Trust Science’s advanced credit default score, built on explainable AI and Machine Learning. It turns millions of complex data points into clear, actionable insights, so you can confidently approve more creditworthy borrowers.

.png)

The Hidden Market in Your Applicant Pool

Traditional credit scoring falls short, often overlooking qualified applicants and causing missed lending (and revenue-making) opportunities.

Right now, a significant portion of creditworthy individuals remain Invisible Prime™ borrowers, people who are simply overlooked by traditional credit systems. Relying solely on conventional bureau data means missing opportunities to serve the very people who could benefit most.

Introducing T°Score™: See Beyond the Bureau

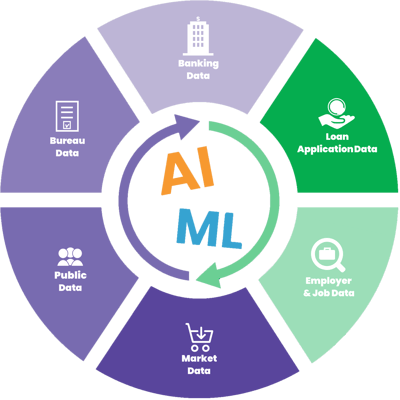

T°Score™ is a powerful, FCRA-compliant credit assessment solution that uses Artificial Intelligence to accurately determine an individual's creditworthiness.

While delivering an intuitive credit score in the familiar 300–850 range, our platform goes beyond what traditional models can see. Using patented algorithms powered by AI and Machine Learning, it analyzes thousands of data points to provide a more complete, accurate, and actionable view of every borrower.

With T°Score™, you get:

More Scored Applications

Greater visibility into thin file applicants that are considered unscorable by the traditional bureaus.

Vertical-Specific Models

Full Compliance

Real-Life, Bottom-Line Impact

See the impact a non-prime lender could achieve in one year by switching to the T°Score™.

Assuming the lender:

- Sees 335,000 non-prime applicants

- Approves 75% of applicants

- Has a $2,500 average loan size

- Earns $700 on good loans and loses $1,850 on bad loans

By using the T°Score™, this lender would see:

- A 16.7% reduction in their default rate

- An additional $16.6 million in earnings

- A 20% lift on return on capital

Here's what the T°Score™ platform includes:

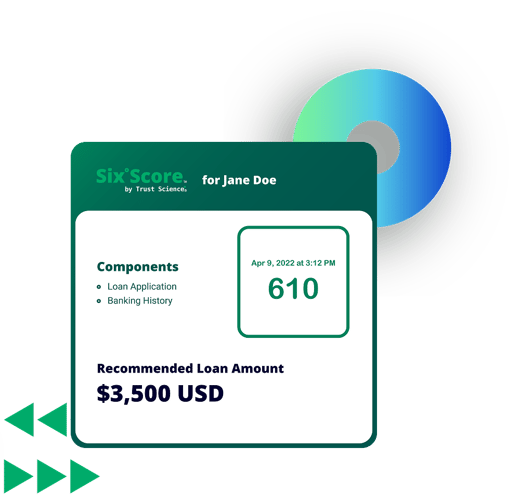

The Six°Score™ Engine

The heart of our platform is the Six°Score™, a powerful AI engine that generates a highly predictive score in the familiar 300-850 range. Unlike traditional models, the Six°Score™ drills into the vast amount of unstructured data available in our hyper-connected world. It leverages Machine Learning and AI to find and analyze digital connections, interactions, and geo-location data to provide a highly accurate consumer rating.

Built on multiple years of experience, we offer specialized models based on industry and type of lending.

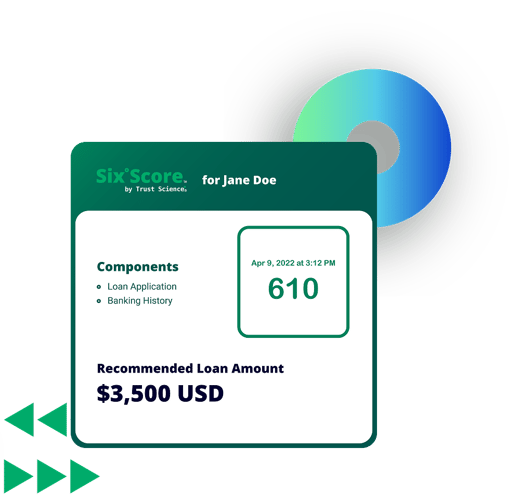

Recommended Loan & Payment Amounts (RLA/RPA)

Go beyond risk assessment and start optimizing for profit. The T°Score™ platform also delivers recommended loan amounts and payment amounts.

This powerful feature provides tailored recommendations designed to optimize the lifetime value of borrowers, helping you structure the right offer for the right applicant, every time.

Automate Your Decisioning

Experience a smarter way to streamline your lending processes with our automated decisioning platform. Eliminate manual oversight and the need for human intervention, aided by our no-code interface, Flow°Builder™, for lead screening, approvals and declines, loan terms, and recommended loan amounts.

Easily implement underwriting processes, product rules, and score cutoffs, all integrated seamlessly through a cloud-based API into your existing lending systems.

The Six°Score™ Engine

The heart of our platform is the Six°Score™, a powerful AI engine that generates a highly predictive score in the familiar 300-850 range. Unlike traditional models, the Six°Score™ drills into the vast amount of unstructured data available in our hyper-connected world. It leverages Machine Learning and AI to find and analyze digital connections, interactions, and geo-location data to provide a highly accurate consumer rating.

Built on multiple years of experience, we offer specialized models based on industry and type of lending.

Recommended Loan & Payment Amounts (RLA/RPA)

Go beyond risk assessment and start optimizing for profit. The T°Score™ platform also delivers recommended loan amounts and payment amounts.

This powerful feature provides tailored recommendations designed to optimize the lifetime value of borrowers, helping you structure the right offer for the right applicant, every time.

Automate Your Decisioning

Experience a smarter way to streamline your lending processes with our automated decisioning platform. Eliminate manual oversight and the need for human intervention, aided by our no-code interface, Flow°Builder™, for lead screening, approvals and declines, loan terms, and recommended loan amounts.

Easily implement underwriting processes, product rules, and score cutoffs, all integrated seamlessly through a cloud-based API into your existing lending systems.

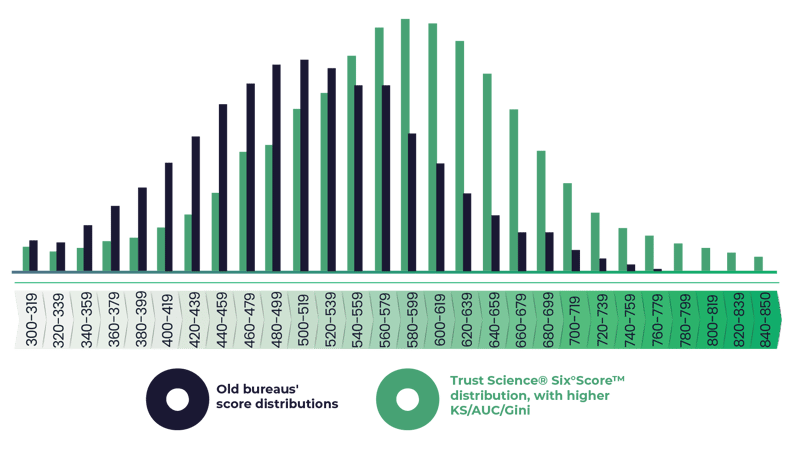

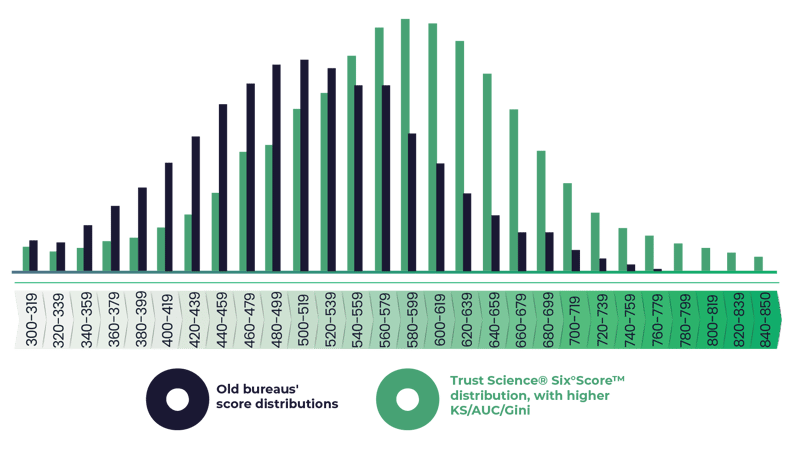

Statistically Validated Results

Our models aren’t just powerful, they’re proven. Based on an aggregated analysis of millions of non-prime borrowers in Canada and the U.S, Trust Science consistently demonstrates substantial lift compared to leading industry benchmark scores.

Key Findings Included:

- · Up to 66.88% KS Lift

- · Up to 48.24% Gini Lift

- · Up to 33.26% Bad Capture Lift

- · Up to 12.10% AUC-ROC Lift

More Than a Score. A Profitability Engine.

We deliver more than just a three-digit number. We provide powerful, operationalized insights to optimize your decisions across the entire lending lifecycle.

Fast, Easy, Efficient Deployment

Don't spend months revising workflows. Our ready-to-use scores integrate seamlessly with your existing LOS/LMS.

Optimize Borrower Lifetime Value

The software offers recommended loan amounts and payment amounts tailored to the customer, designed to optimize the lifetime value of your borrowers.

Confidence in Compliance

Our "No Black-Box AI" approach means you get transparent, ECOA-compliant reason codes with every score.

Get an Estimate, Book a Demo

Ready to harness volatility, maximize your returns, and automate your underwriting? Contact us to see how T°Score™ can impact your bottom line.

Or, email us directly at: Marketing@TrustScience.com