Trust Science Media Kit

Created for journalists and media professionals seeking information about our innovative credit rating technology.

Gain insights into our groundbreaking solutions and the people behind them, and access high-quality images and logos for your media needs.

.png)

TRANSFORMING THE CREDIT INDUSTRY

The Trust Science® Difference

Helping lenders avoid overlooking Invisible Prime™ borrowers and enhance their lending outcomes with:

- T°Score™: Predictive credit scoring tailored to lenders, combining traditional, alternative, and proprietary data to uncover Invisible Prime™ borrowers, reduce risk, and boost approvals.

- CashFlow+™: Comprehensive financial health insights, including income verification, bank data, and cashflow analysis, to enable smarter lending decisions and improve risk assessment.

- Credit Bureau+™: Gain real-time credit data tailored to lending verticals for Invisible Prime™ borrowers that does not appear in traditional credit reports.

Over 90 Million Americans Are:

New to a country

Underbanked

Low-income

New to credit

Which results in thin credit files and inaccurate scores.

Previous Press

TD Bank Group's Global Head of Innovation Joins CEO's Advisory Board

Globe and Mail Report on Business | A Score to Settle

Gartner® Research notes that highlight Trust Science

What Our Customers Say

"I can't say enough about this company's innovation, professionalism, and speed of execution. They are disrupting the credit scoring and loan decisioning industry, and it's about time."

"Working with Trust Science, we have been able to support and enhance our legacy workflow, knockout rules, and business/strategy stipulations with high ROI."

"Today, we rely on Trust Science in every application we look at. The Six°Score™ underpins our decisions."

"This solution is transformative in the under-served, financially-excluded sector of the economy. It can score thin files and no hits, and it can do so in a fluid credit environment."

Trusted by Lenders to Deliver Results

100%

40%

25%

%20(1).png?width=200&height=85&name=logo%20(1)%20(1).png)

%20(3).png?width=200&height=85&name=logo%20(1)%20(3).png)

.png?width=200&height=85&name=Group%2031%20(1).png)

%20(4).png?width=200&height=85&name=logo%20(1)%20(4).png)

.png?width=200&height=85&name=Group%2031%20(2).png)

%20(1).png?width=200&height=85&name=logo%20(1)%20(1).png)

%20(3).png?width=200&height=85&name=logo%20(1)%20(3).png)

.png?width=200&height=85&name=Group%2031%20(1).png)

%20(4).png?width=200&height=85&name=logo%20(1)%20(4).png)

.png?width=200&height=85&name=Group%2031%20(2).png)

%20(1).png?width=200&height=85&name=logo%20(1)%20(1).png)

%20(3).png?width=200&height=85&name=logo%20(1)%20(3).png)

.png?width=200&height=85&name=Group%2031%20(1).png)

%20(4).png?width=200&height=85&name=logo%20(1)%20(4).png)

.png?width=200&height=85&name=Group%2031%20(2).png)

%20(1).png?width=200&height=85&name=logo%20(1)%20(1).png)

%20(3).png?width=200&height=85&name=logo%20(1)%20(3).png)

.png?width=200&height=85&name=Group%2031%20(1).png)

%20(4).png?width=200&height=85&name=logo%20(1)%20(4).png)

.png?width=200&height=85&name=Group%2031%20(2).png)

%20(1).png?width=200&height=85&name=logo%20(1)%20(1).png)

%20(3).png?width=200&height=85&name=logo%20(1)%20(3).png)

.png?width=200&height=85&name=Group%2031%20(1).png)

%20(4).png?width=200&height=85&name=logo%20(1)%20(4).png)

.png?width=200&height=85&name=Group%2031%20(2).png)

%20(1).png?width=200&height=85&name=logo%20(1)%20(1).png)

%20(3).png?width=200&height=85&name=logo%20(1)%20(3).png)

.png?width=200&height=85&name=Group%2031%20(1).png)

%20(4).png?width=200&height=85&name=logo%20(1)%20(4).png)

.png?width=200&height=85&name=Group%2031%20(2).png)

Frequently Asked Questions

Do I have to ‘rip and replace’ my existing solution?

No, we augment your existing data/processes/solutions and work with you to provide optimal results.

How do I use your software?

We provide an online platform to help score your applicants, as well as the ability to work within your LOS/LMS, dependent on if we are already integrated with your chosen LOS/LMS. If not, we can explore opportunities to integrate and consider the engineering work required.

Are you FCRA compliant?

Yes, and compliant with all other relevant legislation and regulations. We work hand-in-hand with regulators to ensure compliance, and undergo periodic audits to ensure that our solutions are de-biased and offer the best possible analytics.

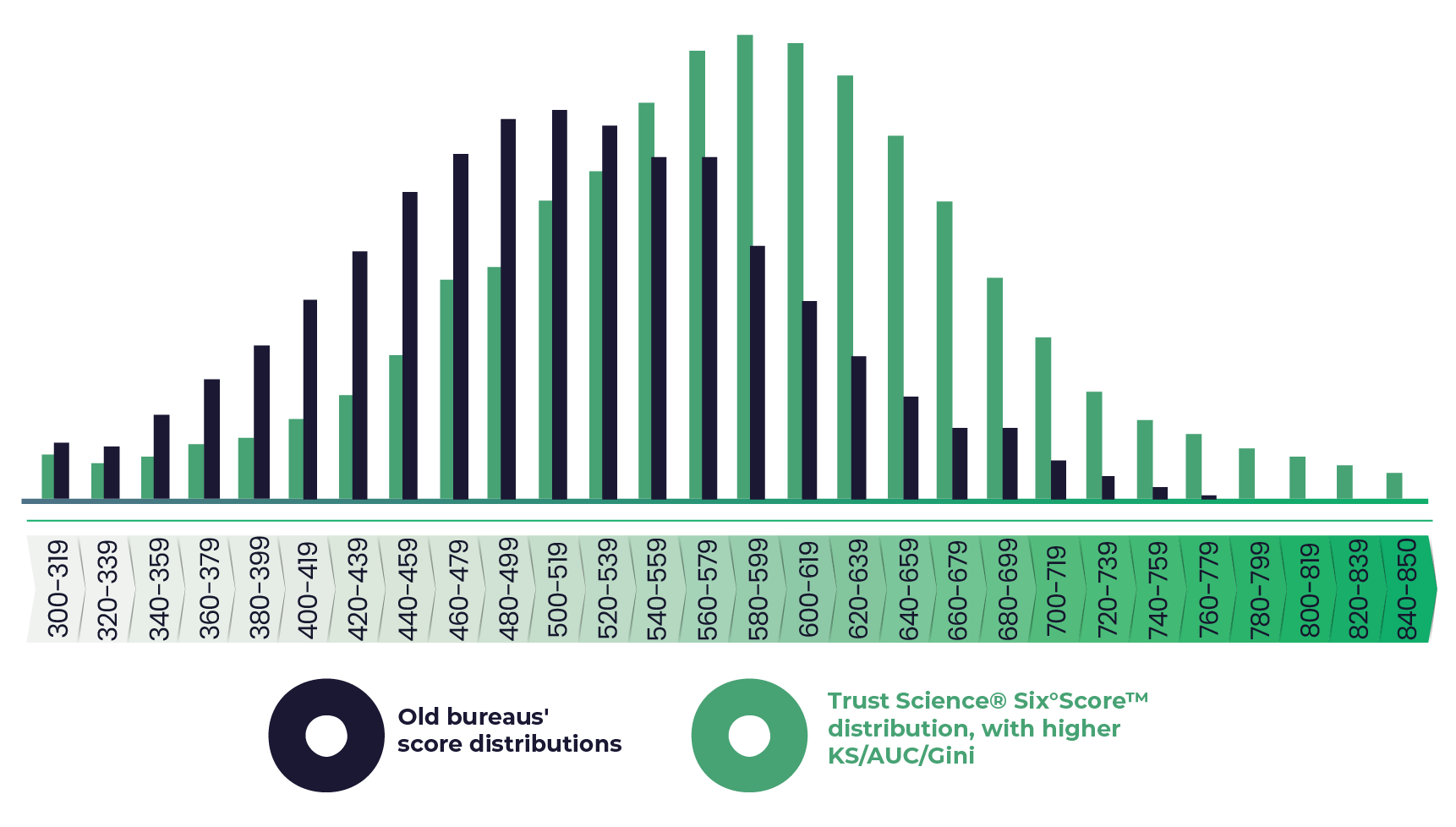

How are your scores similar and different to traditional credit scores?

Scores range from 300-850 and based on the same range of traditional credit Score, relatable and easy to understand. We differ from a traditional credit bureau in three areas:

1. The data that we use – we are not limited to traditional credit data.

2. We are not limited to traditional weightings on the data.

3. Our score takes your business model into consideration – we use your data, your industry, your region, and demographics.

What makes you different? Why would I use you versus someone else?

We are a digital lending service offering immediate and real-time custom scores using machine learning, AI and tens of thousands of data sets.

Our cloud offering constantly improves our models, builds more data and more insights from the data. Plus, we give you automated credit decisioning so you can accelerate the approval process and approve more loans with less overhead.

Are you a credit bureau?

Technically, we are a CRA an consumer reporting agency. We fall under specialty CRAs because we use alternative data. We like to say Credit Bureau+ or Credit Bureau 2.0 because we are the next iteration of what we think a credit bureau should be.

Are you going to share my data with others?

Your privacy and confidentiality are top of mind for Trust Science. We stand behind what our name conveys trust. We don’t share any confidential or private information. Your custom scores are based on your business and the factors that would most influence good vs bad outcomes. So the custom scores we provide are specific to you.

Will I need to replace my LOS/LMS if I use Trust Science?

No, we won’t replace your LOS or LMS. We provide an online platform to help score your applicants, as well as the ability to work within your LOS/LMS, dependent on if we are already integrated with your chosen LOS/LMS. If not, we can explore opportunities to integrate and consider the engineering work required.

The Trust Science Leadership Team

Reid Morrison

Tampa

Mylee Vigness

Salt Lake City

Thomas Brandenburger

South Dakota

Martin Loeffler

CISSP, CISA, CISM, CRISC

Colin Tran

Edmonton

Irene Dimopoulos

Edmonton

Request a Media Kit

Toll Free: + 1 (866) 687-8789 | Direct: +1 (587) 393-6619

Email: marketing@trustscience.com

Floor 11 | 10130 – 103 Street | Edmonton, AB, Canada | T5J 3N9