Media Kit

Discover Trust Science’s Media Kit for journalists and media professionals seeking information about our innovative credit rating technology. Learn about our groundbreaking solutions and the people behind them, and access high-quality images and logos for your media needs. Trust Science is revolutionizing the credit industry with cutting-edge AI-powered tools. Explore our MediaKit today.

Transforming the Credit Industry

The Trust Science® Difference

STOP missing and dismissing Invisible Prime™ borrowers and boost your lending with

Learning System to Harness Volatility

Immediate Explainability

Advanced Logic to Automate Decisioning

Incorporate Deal Structures, Assets, and Co-Borrowers

Promoting Financial Inclusivity by Helping Underserved Consumers

50+ PATENTS & TRADEMARKS

14 + COUNTRIES

OVER 90 MILLION AMERICANS ARE

NEW TO COUNTRY

UNDERBANKED

LOW-INCOME

NEW TO CREDIT

Resulting in thin-file, inaccurate credit scores.

A Solution Catered to You

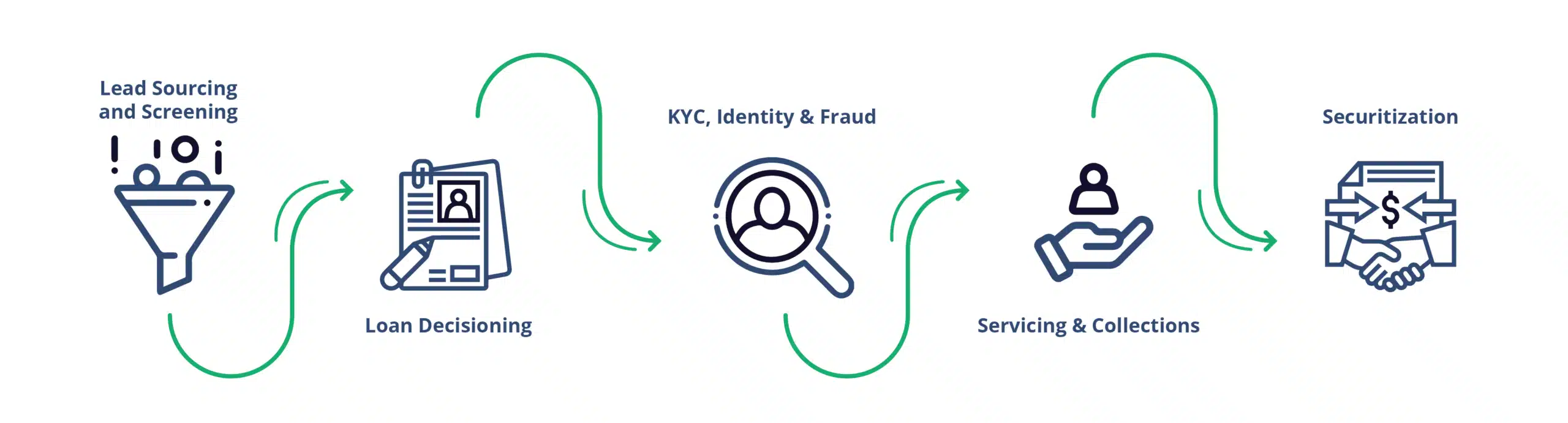

Utilize the full functionality of Trust Science's FCRA-compliant platform

Augment your loan process with our fully interactable system

Data and Analytics

AI & inclusive data for custom insights

Enrichment

AI informed decisions with our D2C mobile app

Reporting

Holistic Performance Management

Augment your loan process with our fully interactable system

Data and Analytics

AI & inclusive data for custom insights

Enrichment

AI informed decisions with our D2C mobile app

Enrichment

AI informed decisions with our D2C mobile app

Optimize Your Marketing

Buy and nurture leads sources with our propensity models utilizing automated sourcing, pre-screening and pre-qualification

>90% APPROVAL RATE

Align marketing and underwriting to streamline operations

2X MORE LOANS

Increase originations and lower write-offs

68% MORE CONVERSIONS

With targeted, pre-qualified offers

Optimize Your Marketing

Buy and nurture leads sources with our propensity models utilizing automated sourcing, pre-screening and pre-qualification

>90% APPROVAL RATE

Align marketing and underwriting to streamline operations

2X MORE LOANS

Increase originations and lower write-offs

2X MORE LOANS

Increase originations and lower write-offs

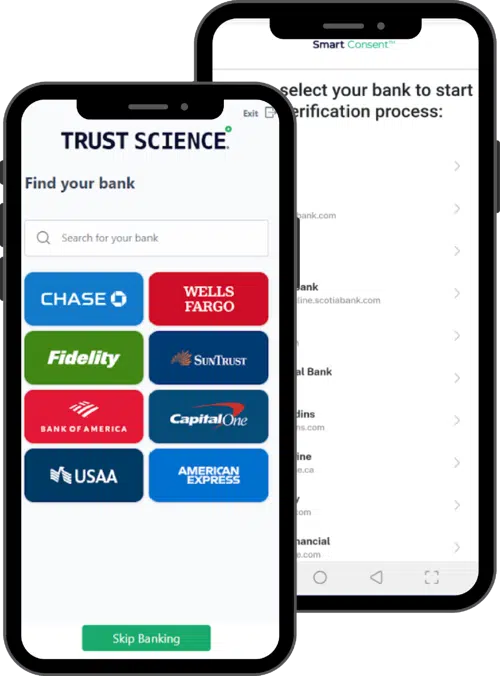

- Verification of Income & Employment (VOIE)

- Instant Bank Verification (IBV)

- Know Your Customer (KYC)

- Direct-to-consumer mobile interface for consented data

Client Impacts

20-200X ROI

Clients have seen double-digit ROI with Trust Science through increased originations, decreased charge-offs, and streamlined processes.

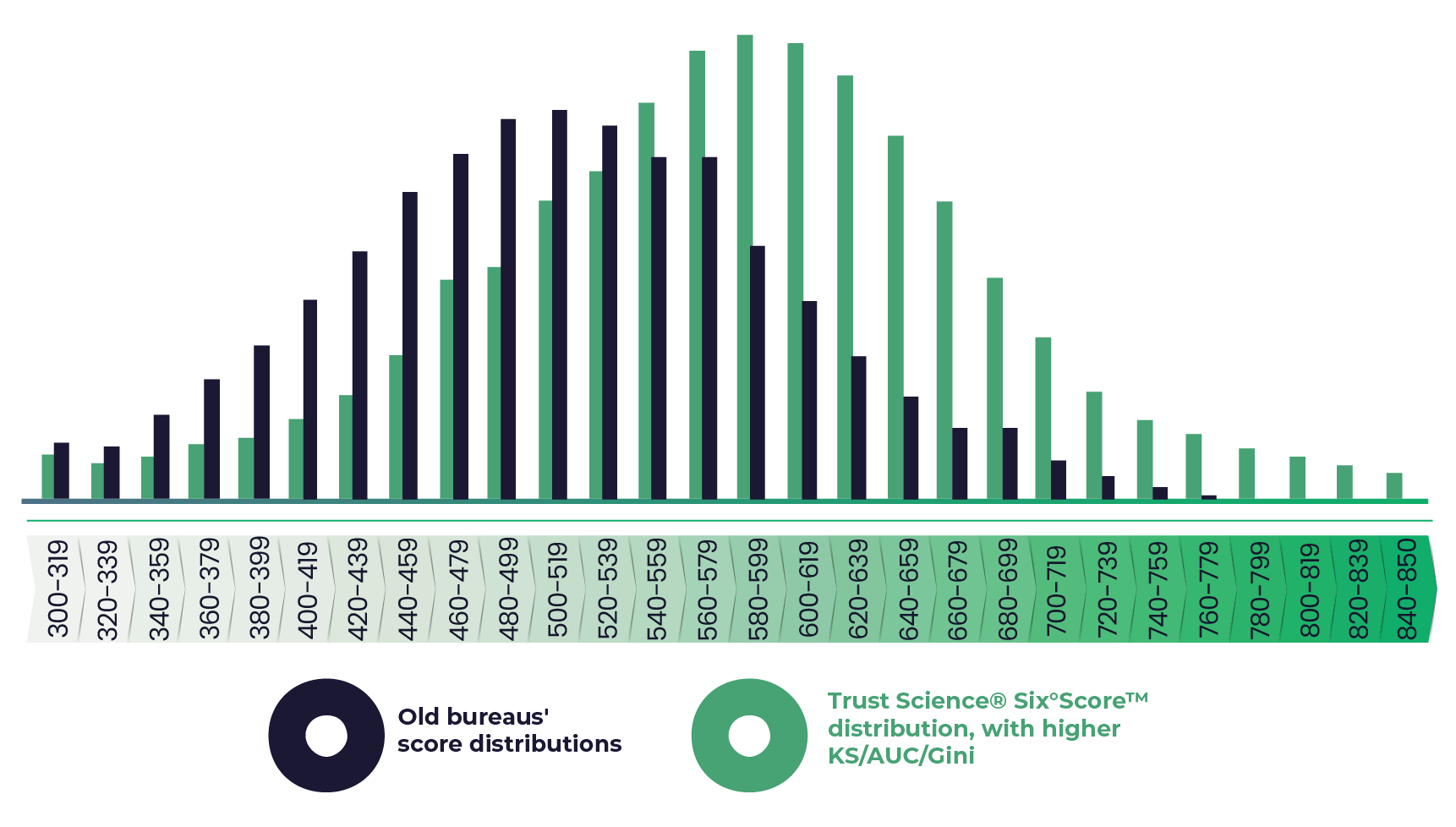

K-S Lift

VS. Major bureau performance data

Less Charge-Offs

Statistically reducing defaults

More Loans

Increase quality originations

See How Our Products Work Together!

Trust Science® is proud to announce that distinguished global banking and FinTech leader Imran Khan, P. Eng., MBA, has agreed to join the CEO’s volunteer Advisory Board.

Trust Science® is honored to be recognized by Real Leaders among an exclusive list of global companies alongside household names, like Microsoft and Tesla, that are ESG-forward and leading their respective industries.

In this article, The Globe and Mail, a highly reputable Canadian business publication similar to the WSJ or Washington Post, praises Credit Bureau 2.0® for disrupting the out-of-touch, multi-billion dollar international dinosaurs of the credit industry.

In this research note, Trust Science® is featured in “Case in Point 1: Trust Science – Credit Scoring” as an innovative company with seeking to disrupt traditional business processes.

Increase in Loan Originations

Increase in Approval Rates

Decrease in Defaults & Charge-Offs

What Our Customers Say

Frequently Asked Questions

No, we augment your existing data/processes/solutions and work with you to provide optimal results.

Yes, and compliant with all other relevant legislation and regulations. We work hand-in-hand with regulators to ensure compliance, and undergo periodic audits to ensure that our solutions are de-biased and offer the best possible analytics.

We are a digital lending service offering immediate and real-time custom scores using machine learning, AI and tens of thousands of data sets.

Our cloud offering constantly improves our models, builds more data and more insights from the data. Plus, we give you automated credit decisioning so you can accelerate the approval process and approve more loans with less overhead.

Technically, we are a CRA an consumer reporting agency. We fall under specialty CRAs because we use alternative data. We like to say Credit Bureau+ or Credit Bureau 2.0 because we are the next iteration of what we think a credit bureau should be.

We provide an online platform to help score your applicants, as well as the ability to work within your LOS/LMS, dependent on if we are already integrated with your chosen LOS/LMS. If not, we can explore opportunities to integrate and consider the engineering work required.

Scores range from 300-850 and based on the same range of traditional credit Score, relatable and easy to understand. We differ from a traditional credit bureau in three areas:

1. The data that we use – we are not limited to traditional credit data.

2. We are not limited to traditional weightings on the data.

3. Our score takes your business model into consideration – we use your data, your industry, your region, and demographics.

Your privacy and confidentiality are top of mind for Trust Science. We stand behind what our name conveys trust. We don’t share any confidential or private information. Your custom scores are based on your business and the factors that would most influence good vs bad outcomes. So the custom scores we provide are specific to you.

No, we won’t replace your LOS or LMS. We provide an online platform to help score your applicants, as well as the ability to work within your LOS/LMS, dependent on if we are already integrated with your chosen LOS/LMS. If not, we can explore opportunities to integrate and consider the engineering work required.