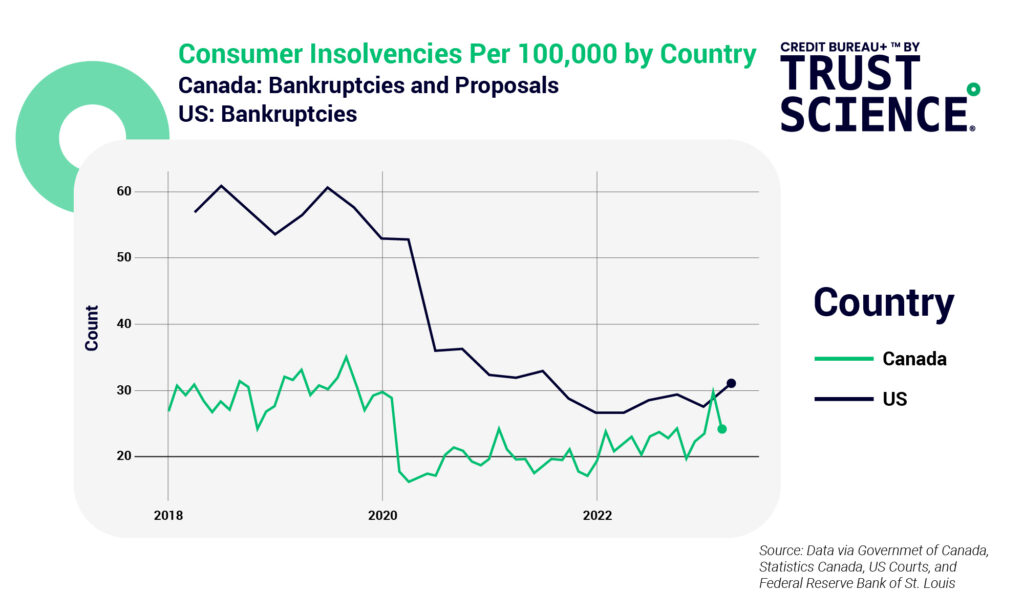

Bankruptcies have risen in Canada and the US post Pandemic

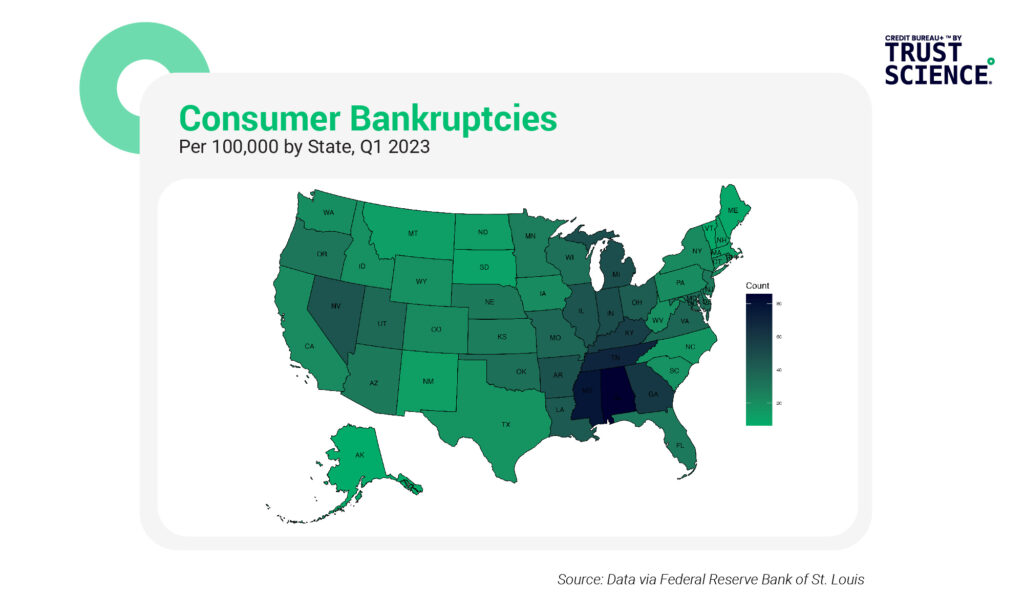

With the end of federal pandemic aid in the United States, bankruptcies have risen among both individuals and businesses. In January, total bankruptcy filings increased by 19% compared to the previous year, with a 20% increase in Americans filing for bankruptcy across different chapters. Many people are now struggling to meet mortgage and car payment obligations without financial assistance. Macroeconomic factors including rising interest rates, high inflation, difficulties in hiring, volatility resulting from the war in Ukraine, and recession fears have also contributed to the rise in bankruptcies. While bankruptcies have increased, they have not yet reached pre-pandemic levels. The temporary lifelines provided by the government through stimulus payments and paycheck protection loans have ended, and the reality of financial challenges is setting in for individuals and companies.

Bankruptcies have risen as a consequence of increases in BNPL, and Payday Loans

A study conducted by licensed insolvency trustees Hoyes, Michalos and Associates Inc. revealed that almost half of all insolvencies filed in 2022 in Canada were by millennials, despite accounting for less than 27% of the adult population. Millennials were the only age group to see a rise in unsecured debt obligations, with an average debt load of $47,283. The causes of the insolvency included high levels of student loan debt, reliance on credit cards and high-cost loans. Much of this loan value was accounted for by rapid high-cost loans, such as payday loans– a significant driver of subprime consumer insolvencies. The average insolvent debtor with this type of loan owed money to four different lenders, with a total debt load of $12,100.

Outlook

Experts predict that bankruptcy filings will continue to climb, especially if the U.S. enters a recession. However, one potentially positive aspect of increased bankruptcies is the opportunity for new entrepreneurs to fill the gaps in the market left by failing businesses. With a looming recession and rising unemployment rates expected to push more Canadians into loan delinquencies and insolvencies, consumer insolvencies are projected to increase by almost 30% over the next three years, returning to pre-pandemic levels. The burden of debt has become heavier for households, and the combination of the recession and higher interest rates will continue to erode personal and household savings rates and add further stress to financially-stretched borrowers. As insolvencies continue to trend higher, it will become increasingly important for lenders to look towards Invisible Primes™ to offer loans and increase originations with creditworthy consumers.