Toronto, Canada, Feb. 7, 2022 -www.TrustScience.com Inc. (“Trust Science”), which delivers its Credit Bureau 2.0® Fintech SaaS to modern lenders, proudly announces that Imran Khan, P.Eng., MBA has agreed to join the CEO’s volunteer Advisory Board.

Mr. Khan is Global Head of Innovation at TD Bank Group (TD). TD is a top 5 North American bank by assets ($1.7 Trillion) and one of the world’s top 30 systemically important banks.

Mr. Khan joins other industry luminaries on Trust Science’s Board of Advisors such as Mr. Don Guloien, who was most recently the CEO of $1+ Trillion (AUM) Manulife Financial, and Mr. David Ebersman who was the CFO of Meta at the time of its then record-breaking $100B IPO.

Mr. Khan will guide Evan Chrapko, the Founder and CEO of Trust Science, as Evan rapidly scales up his compliant, highly predictive, global service for credit scoring and risk-informed marketing (pre-qualification, pre-screening and direct mail.) Mr. Khan has had a successful 24-year career on the cutting edge of commercializing and deploying innovative technology.

Most recently, Mr. Khan was the President and CEO of UGO, a mobile accelerator within TD’s innovation ecosystem, while also heading up Global Digital Experience at TD, driving innovative digital experiences for the bank’s 15 million digitally active customers. Prior to TD, Mr. Khan held senior leadership roles at Deloitte Consulting and several successful tech companies including as an Engineer for the F22 aircraft.

“Few people have Imran’s deep skills, insights and experience in financial technology. And he earned his unique qualifications ‘on the battlefield’ of in-market, high-quality execution.” says Evan Chrapko, Founder & CEO, Trust Science. “As my team and I pursue rapid delivery of high value with our extremely technical service and our important social mission, I will be relying on Imran’s wise, gifted insight every step of the way.”

Mr. Khan is a member of the exclusive, worldwide Young Presidents’ Organization (“YPO” at YPO.org), was recognized with a nomination for Technology Leadership in the 2021 Fintech Futures global Banking Tech Awards held in London, UK, a list in which he appeared alongside peers from Morgan Stanley, Marqeta, and J.P. Morgan. Mr. Khan was also awarded the distinction of Top Tech Titan in 2019 alongside peers from IBM, Uber and RBC.

“Having seen Evan in action, he is that rare serial entrepreneur who is willing to tackle world scale issues.” says Imran Khan, Global Head of Innovation, TD Bank Group. “Evan has a track record of success and demonstrated ability to build strong teams that are up for any challenge.”

About Trust Science Inc. (see global I.P. map here)

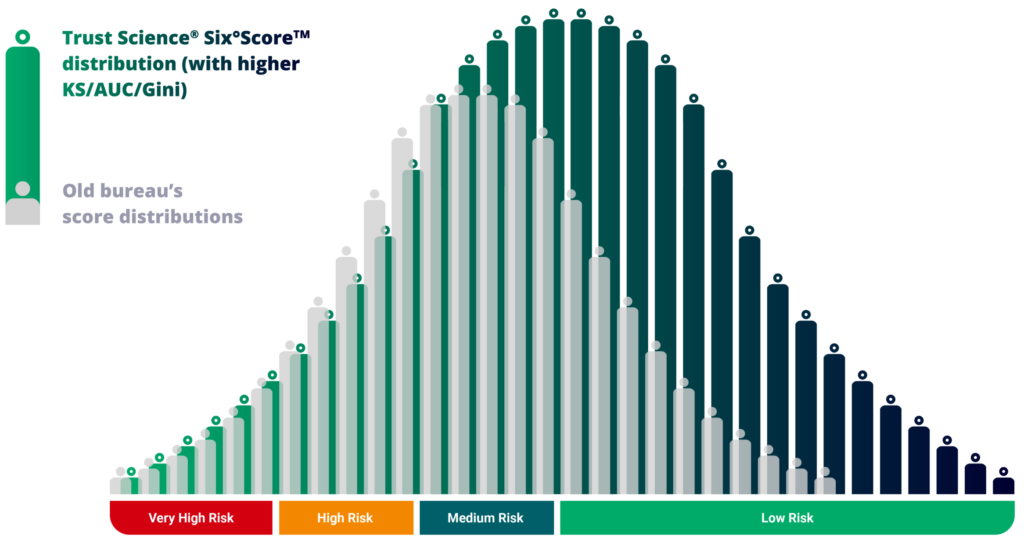

Trust Science® delivers its Credit Bureau 2.0® SaaS to lenders. This award-winning FinTech uncovers Invisible Prime™ and Hidden Prime™ borrowers for banks, credit unions and consumer finance companies. Its mission is To Allow Deserving People to Get What They Deserve. Superior decisions (which the F.I. industry calls “lift”) go straight to the lender’s bottom line, delivering risk-adjusted ROIs of up to 200x and material increases to ROA, ROC (Finance), AUC, KS & Gini (Statistics). In addition to de-risking lenders’ ability to give loans to deserving applicants who are wrongly scored by conventional means, Trust Science also brings a risk lens to the Marketing function (pre-qualifying, pre-screening, and direct mail.) Financial Inclusion and economic mobility is delivered to consumers by accurately assessing systemically excluded, thin file, and so-called ‘no hit’ loan applicants. Previously marginalized people now have an onramp into the modern economy, which is a multi-Trillion-dollar global opportunity, if they are approaching a lender that uses Credit Bureau 2.0. Gartner® has cited Trust Science contributions re: Explainable AI (“xAI”) research and Trust Science also prioritizes compliance with consumer protection and privacy laws like FCRA, ECOA, PIPEDA & CCPA. Importantly in these volatile and privacy-challenged times, this platform has productionized Statistical Learning and it also has direct-to-consumer Smart Consent™ technology for gathering consented/permissioned data from loan applicants. The technology and methods harnessed to make this possible are now protected by 44 patents (2 of which have been successfully used in an offensive capacity in the U.S.) and trademarks granted across 19 different countries, with another 38 patents still pending. The company is led by a serial technology commercialization entrepreneur who has delivered over $1/2 Billion of gains to shareholders in his career, and who was recently added to a list of the Top 50 CEOs in A.I. The company was recently included in the Global Impact 200 alongside 17 other ESG-forward technology companies like Microsoft and Tesla. Trust Science is preparing to raise funds at the Series B level into one of the business world’s most simple cap tables.

Trust Science, Credit Bureau 2.0 and Troo are registered trademarks and Invisible Prime, Hidden Prime, Smart Consent, Credit Bureau +, Credit Bureau 3.0, Credit Bureau 4.0, Personal Credit Bureau, Six°Score, Auto Six°Score, Auto Bureau and Auto Credit Bureau are trademarks of www.TrustScience.com Inc.

TD, TD Bank, TD Bank Group, UGO Mobile Solutions, Gartner, Meta, Facebook and Manulife Financial are the property of their respective owners.