The global recognition highlights Trust Science’s position among other international FinTech unicorns. Trust Science’s SaaS offering enables automated credit decisioning for lenders. Further, lenders can score a borrower’s creditworthiness with financial inclusive and consented data. Lenders are now able to score thin-file and no-hit borrowers.

The Banking Technology Awards recognize excellence and innovation in the use of IT in financial services worldwide. The awards attract major players and specialists in the sector, with attendees including JP Morgan, Morgan Stanley, Deutsche Bank, Virgin Money, TSB, Lloyds Bank, HSBC, Alior Bank, Nordea, DBS Bank, Barclays, and OakNorth, among others.

“We’re humbled to be amid such highly respected peers in the global FinTech community,” said Evan Chrapko, Trust Science’s Founder & CEO. “Thanks to the power of AI and financial inclusive data, lenders can now make sure that borrowers get the money they deserve. Our universal credit scoring service–Credit Bureau 2.0™–is now a reality, which we have patented in a dozen countries around the world.”

About www.TrustScience.com USA Inc.

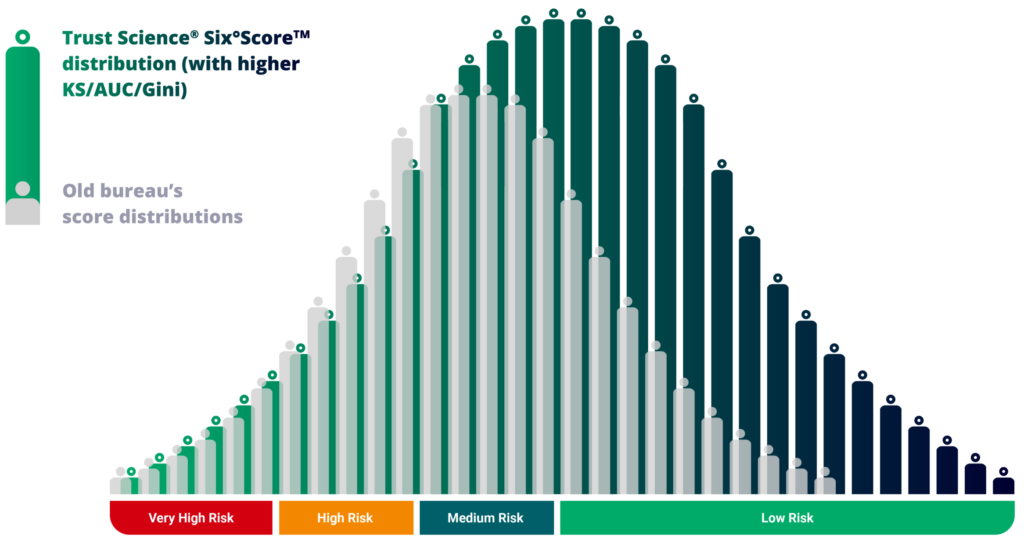

Trust Science ® builds and delivers Credit Bureau 2.0™ This is the world’s leading provider of AI-sourced and AI-analyzed alt.data to generate highly predictive credit scores for lenders around the world. Trust Science sifts Prime-quality loan applicants out of the wrongly-scored, so-called subprime pool. Optionally, the system can also obtain consented mobile data using its patented (30+ patents across 12 countries) data collection methods. Lenders get increases in their loan origination volumes, reduction in default rates and double-digit ROI. They also reduce OpEx thanks to more automation and fewer human errors. Trust Science is a winner of the Red Herring North America Top 100 award, and “Smartest Companies to Watch” from Cherokee Media.