For the second consecutive year, Trust Science occupied the #20 spot on the Globe and Mail’s list of over 400 Top Growing Companies in 2023.

The Globe and Mail, a leading publication reaching over 6 million readers every week, evaluates thousands of companies for eligibility for the award across all sectors of the economy. Trust Science’s back-to-back appearance on a list honoring fast growth is testament to its market-validated leadership in lending innovation on the world stage.

“We have a heartfelt commitment to develop a meaningful platform to revolutionize how ethical lenders find great borrowers,” says Evan Chrapko, Founder & CEO. “We are incredibly proud of our continued success and growth, especially in an economically volatile period, and thank our lender customers for voting for us with their dollars, their data and their time.”

Trust Science has evolved to become far more than an industry-leading score provider: platform capabilities have expanded to include a fully configurable Virtual Loans Officer capable of automating an entire lending decision from approval to deal terms in seconds, Generative AI products that interactively collect real-time data from borrowers, and an entire suite of lead acquisition, direct marketing, portfolio management, and securitization solutions. With Trust Science, lenders are better serving more customers with less risk, all while automating the entire process from Lead to Loan™.

The company’s continued innovations and recent breakthroughs in Generative AI, along with overall market trends, suggest that Trust Science will be back on this “fastest growing” list for a third consecutive year. The US market, in particular, has begun aggressively adopting decision automation to more effectively and efficiently process loan applications, with many lenders starting to gain advantages with intelligent upstream lead sourcing and screening. Advanced banks and consumer finance companies have begun actively seeking Lead to Loan™ capabilities that approve and convert consumers instantly at the point of first touch. Furthermore, the asset-backed securities market – both buyers and sellers – is starting to turn to alternatives to legacy systems to better price and structure their securities. Trust Science’s suite of cutting-edge technologies are well-positioned to provide lenders with a seamless, end-to-end solution across their business today and into the future.

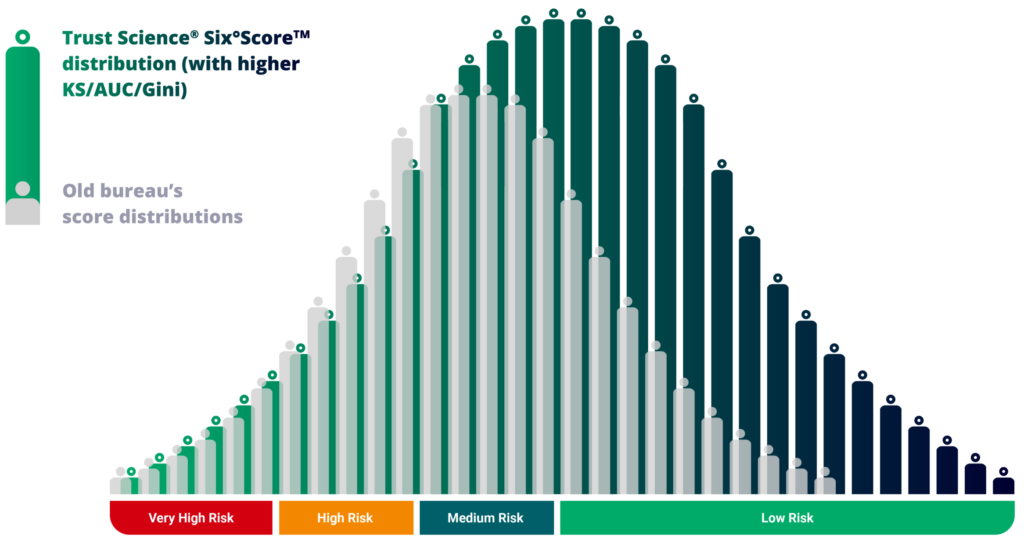

Since its inception, Trust Science has also remained fiercely committed to compliance, fairness, transparency, and inclusion. With over 1 in 5 adults in the US and Canada lacking a fair credit assessment, Trust Science’s explainable AI platform provides a 360° view of the consumer in a fully explainable way, ensuring that “credit invisibles” and Invisible Prime™ borrowers are no longer left behind in the modern economy.

“For Trust Science, it’s about more than just baseline compliance with the FCRA, ECOA, PIPEDA, or other legislation,” stated Chrapko. “We are truly focused on building a fair, ethical & explainable on-ramp to financial inclusion and repairing the Credit Catch-22™, leading to better financial outcomes for so many marginalized groups.”

Trust Science continues to pursue growth and will be attending a string of conferences and events in the coming weeks. Learn more about Trust Science by visiting www.TrustScience.com or contact Trust Science at [email protected]

About Trust Science

Trust Science® revolutionizes lending with its Credit Bureau+™ SaaS, a pioneering Invisible Prime™ and Hidden Prime™ FinTech solution that accurately identifies risk-appropriate borrowers for banks, consumer finance firms, and securitization entities/ABS buyers. Its mission is to empower deserving individuals to access the financial opportunities they merit. Cutting-edge technology delivers superior decisions, significantly boosting lenders’ bottom line with risk-adjusted ROIs as high as 201x and substantial increases across key financial metrics. By mitigating lending risk and extending financial inclusion, Trust Science drives economic mobility, particularly for systemically excluded, thin-file, and ‘no hit’ applicants. The Trust Science platform is deeply committed to compliance with global consumer protection and privacy regulations while integrating productionized Statistical Learning via a scalable MLOps framework, coupled with unique Smart Consent™ technology for ethical data acquisition. Backed by 55+ patents and trademarks across 19 countries, Trust Science is helmed by a visionary leader recognized alongside industry giants. The Trust Science impact is underscored by inclusion in the Global Impact 200 and different rankings of the fastest-growing companies globally.

Trust Science®, Credit Bureau 2.0® and Troo® are trademarks that are legally registered to www.TrustScience.com Inc. by the U.S. Patent & Trademark Office.

Credit Bureau+™, Six°Score™, Smart Consent™, Hidden Prime™, Invisible Prime™, Credit Bureau 3.0™, Credit Bureau 4.0™, Personal Credit Bureau™, Personal Data Vault™, Auto Six°Score™, Auto Bureau™, Auto Credit Bureau™, Rating Agency 2.0™, Rating Agency 3.0™, Cashflow Bureau™, One Touch Lending™, Lead to Loan™, Lender in the Cloud™, Anna™, Anna the Virtual Loans Officer™, Ginny for VOI™,FCRA-Compliant Insights From Lead to Loan™, Go Beyond the Bureau™, Fixing the Credit Catch-22™, Find Invisible Primes™, My Personal Bureau™, Lulu™, LuLu the Lead Source’ress™, and Helping Lenders Find Great Borrowers™ are trademarks of www.TrustScience.com Inc.