The award recognizes companies with over $2M in annual sales and three-year revenue growth over 50%: Trust Science® easily exceeded the contest’s hurdles with a three-year growth rate over 2,100%. Trust Science was also featured in a special article here: https://www.theglobeandmail.com/business/adv/article-how-trust-sciences-credit-reporting-technology-helps-serve-the/

- The company’s Credit Bureau+™ (a FinTech SaaS platform) helps lenders find and lend to over 70M “Invisible Prime™” borrowers that conventional credit scoring systems fail to see or who are simply scored wrongly.

- Lenders have enjoyed 25% fewer defaults, over 50% more originations, and double- or triple-digit ROI.

- Growth is just getting started; more lending leaders across the US and Canada are harnessing Credit Bureau+ for lead screening and credit adjudication.

Finding Over 70 Million Credit Invisibles & Wrongly Scored Borrowers

Driven by Explainable AI (“xAI”) and statistical learning technology, Credit Bureau+ is capable of actually exploiting today’s volatility to produce highly accurate and FCRA-compliant scores despite gyrating economic conditions. Critically, Trust Science provides its lender customers with an accurate assessment of historically underserved populations – what Trust Science calls Invisible Primes.

“More and more lenders, through COVID and all of the recent market uncertainty, are realizing that conventional ‘borrower assessment’ doesn’t work for a massive tranche of consumers,” says Trust Science Founder, Chairman, and CEO, Evan Chrapko. “With over 40% of conventional scores under 700 being inaccurate, lenders are looking for ways to automate their operations & also get more accurate lead screening and application adjudication – solving this economy-wide issue has spurred our growth”.

As Trust Science continues its rapid ascent as one of Canada’s Top Growing Companies – aiming to enjoy that same moniker for the whole of North America – it will continue to focus on helping lenders find better marketing leads and make better-informed loans. Not only does this allow lenders to safely serve consumers during ever-increasing volatility, but it also creates avenues for financial inclusivity and an on-ramp for previously marginalized people into the modern economy – a key aspect of the Trust Science mission.

“Time, money and ingenuity have been our ingredients, and financial inclusion for deserving-but-overlooked borrowers has been our achievement,” adds Chrapko. “Our platform has scored millions of files and we aim to score tens of millions in the not-too-distant future. My team of geniuses and our advanced customers are making a positive social impact, especially for Invisible Primes – people such as youth, BIPOC, immigrants, and other marginalized demographics.”

Innovation and Disruption of the Dinosaur Credit Scoring Industry

Years of R&D, holding to a vision, and in-market execution went into becoming a Top Growing Company. Now, lenders can make more accurate, FCRA-compliant decisions throughout the entire life cycle of a borrower. Trust Science’s proprietary FinTech SaaS that predicts consumers’ borrowing behavior injects value anywhere in a lender’s business, from lead sourcing and screening to loan decisioning, identity and fraud protection, and even securitization negotiations.

“Trust Science is one of the first to master Explainable AI and statistical learning for commercial use cases,” added Chrapko, who comes from a background as a serial technology entrepreneur specializing in industry disruption and has delivered over $1/2B in shareholder gains. “Combining this with our battle-hardened security and our decisioning logic unlocks so many more capabilities that we can deliver to our customers – capabilities that would make the conventional industry giants’ heads spin.”

Trust Science has built a cloud-native, mobile-native platform from the ground up. This is a departure from some dominant, multi-Billion dollar, global players that are trying to either update or flee their old, existing mainframe-style infrastructure and older methods of computer modeling, and some of whom are siloed country-by-country. Trust Science’s global architecture and its cutting edge technology has been protected with 50 patents granted from 13 different countries, and it still has many more patents pending.

2,144% Growth is Just the Beginning

As a bootstrapped company without any institutional investors, Chrapko has self-funded to date, along with supportive, high-caliber individual investors like the recent investment made by Seattle’s so-called Unicorn Whisperer. With relentless global volatility and as more and more lenders come to realize conventional credit marketing & assessment methods have been eclipsed, Trust Science’s growth is just beginning.

“Extreme growth is extremely expensive. As we head toward cash-flow break-even, now is the time to engage with growth-minded, permanent and/or strategic institutional investors who can write 8-figure checks and add tangible non-monetary value,” says Chrapko. “Our mission is to help deserving people get the loans they deserve, and there are billions of them in the world, in dire straits, because lenders haven’t had a proper scoring/decisioning system until now.”

About Trust Science Inc.

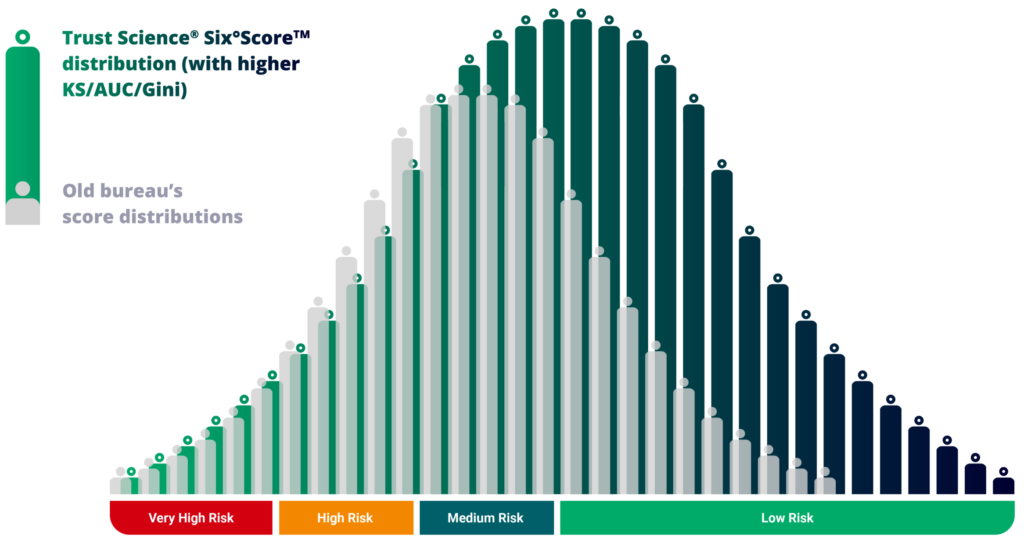

Trust Science delivers its award-winning Credit Bureau+™ FinTech SaaS for banks, credit unions, and consumer finance companies, uncovering the 70M+ Invisible Prime™ and Hidden Prime™ borrowers missed by conventional lead sourcing/screening & loan adjudication. Its innovative technology is protected by 50 patents (2 of which have been successfully used in an offensive capacity in the US) and trademarks granted across 19 countries with many more patents and trademarks still pending. Trust Science enables superior lender insights and decisions, From Lead to Loan™, delivering ROIs of up to 201x and material increases in numerous financial (ROE, ROA) and statistical metrics such as (AUC/ROC, KS, and Gini.) Trust Science has been cited by PwC® and Gartner® and was included in the 2022 Real Leaders®’ Global Impact 200 list alongside other ESG-forward technology companies like Microsoft® and Tesla®. Trust Science prioritizes compliance with consumer protections and privacy laws (e.g., FCRA, ECOA, PIPEDA, CCPA.) Trust Science is preparing to raise funds at the Series B level into one of the business world’s simplest cap tables.

Trust Science, Credit Bureau 2.0 and Troo are registered trademarks and Lead to Loan, Invisible Prime, Hidden Prime, Smart Consent, Credit Bureau+, Credit Bureau 3.0, Credit Bureau 4.0, Personal Credit Bureau, Six°Score, Auto Six°Score, Auto Bureau and Auto Credit Bureau are trademarks of www.TrustScience.com Inc. All other marks are trademarks or registered trademarks of their respective owners.