“I’m ecstatic for our team. To be acknowledged as a Top 100 Company by Red Herring’s panel of industry experts, insiders and journalists is proof we are making a difference,” said Trust Science CEO Evan Chrapko. “Our goal is to get deserving people access to affordable financial services they so desperately need, and this is another step toward making that happen.”

He added, “To join the likes of LinkedIn, DropBox and DocuSign as previous Top 100 Winners is humbling, but incredibly energizing for our team.”

Red Herring chairman Alex Vieux led the ceremony, noting “What has excited me most is to see so many people forging niches in high-tech and cutting edge sectors,” added Vieux. “Some of the technical wizardry and first-rate business models showcased here at the conference has been fantastic to learn about. We believe Trust Science embodies the drive, skill and passion on which tech thrives. Trust Science should be proud of its achievement – the competition was incredibly strong.”

The Top 100 Winners were whittled down from thousands of entrants after a number of interviews and presentations. Companies were judged on a wide variety of criteria including financial performance, innovation, business strategy, and market penetration.

Following Trust Science’s Top 100 win, they are invited to the next step, which is to present at the Top 100 Global event in November that will encompass the best-in-show from the Top 100 Europe, North America, and Asia.

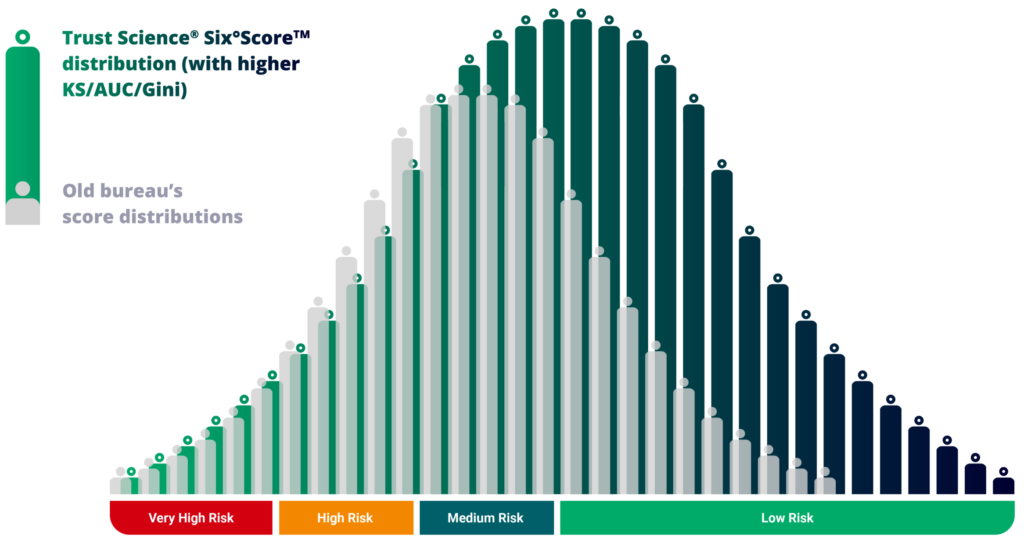

Trust Science provides AI-powered alternative credit scoring to lenders, helping them identify and approve subprime applicants who are declined by traditional credit underwriting models. Trust Science gathers alternative unstructured data and consented mobile data using its patented (30+ patents across 6 countries) data collection methods, and builds custom underwriting models for short term, installment, direct auto and indirect auto lenders. Lenders see increases in their loan origination volumes, reduction in default rates and double digit ROI.

In the future, as Trust Science delivers its FCRA-compliant Credit Bureau 2.0(TM) service to more countries, it will also begin to expand its domain into scoring Insurance underwriting applications and scoring people for purposes of Shared transactions (eg Airbnb, Uber, Dating sites, Craigslist), as well as Sales/Marketing acceleration, Employment screening, and Counter-terrorism.